Parent Press Week 5 of the 2026 Legislative Session

One of the most talked-about proposals of this legislative session – LG Burt Jones and Senate Republicans’ bills to drastically cut the state income tax - hit the Senate floor this week. Meanwhile, I declared this week Congenital Heart Defect Awareness Week, and filed several new pieces of legislation.

Save the Date for Upcoming Events:

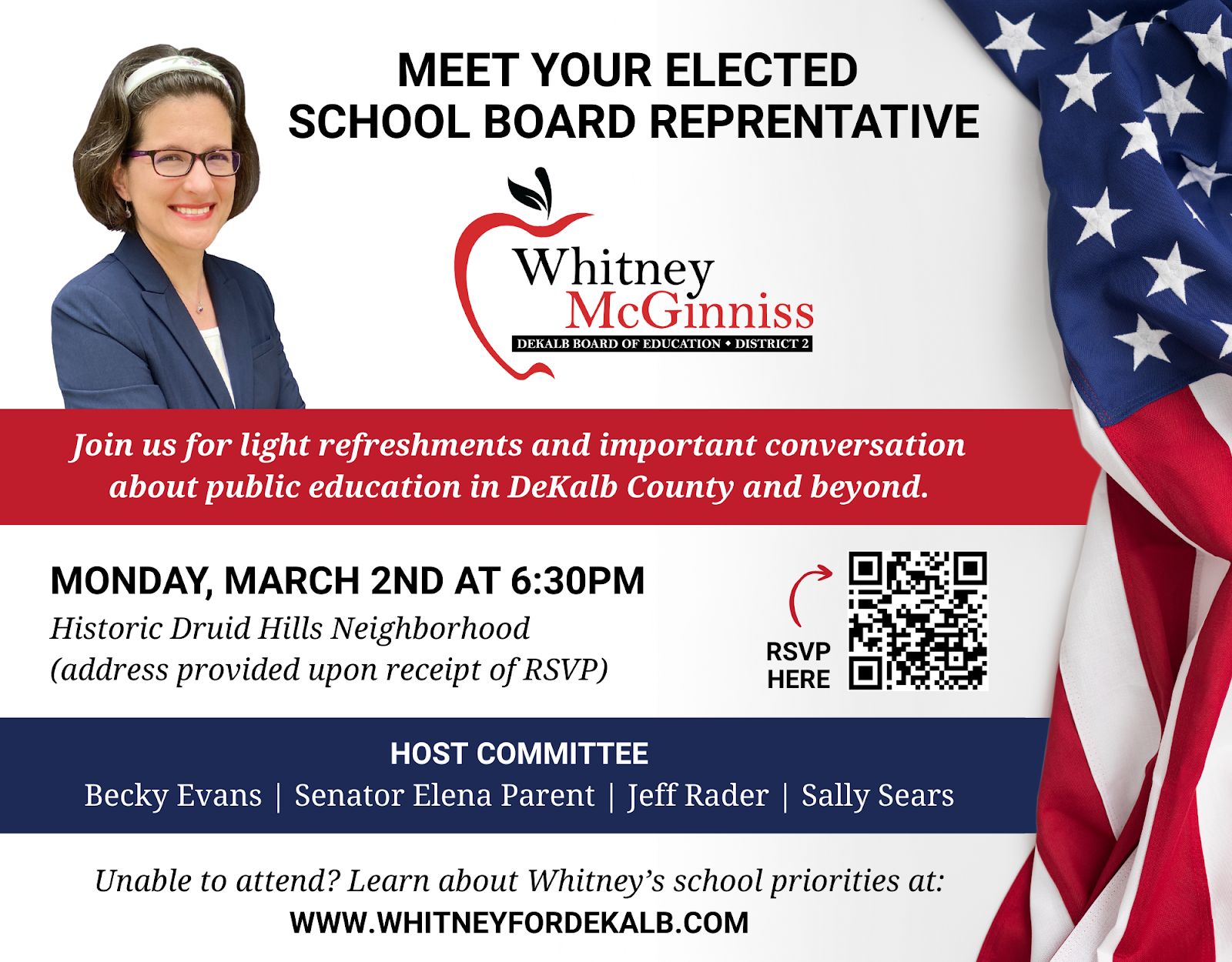

Meet and Greet in Druid Hills with Whitney McGinniss, DeKalb School Board Member. Whitney is up for re-election this May. Don’t miss this opportunity to meet her and hear what’s going on in the DeKalb County School District.

TOWN HALL! Please join me and Rep. Saira Draper for a Town Hall on Tuesday, Mar 3, 2026 at the Sugar Creek Golf and Tennis Club, 2706 Bouldercrest Road, Atlanta, GA 30316. More details to follow.

The Republican Tax Fairy Tale

On Thursday, the Senate voted to pass SB 476 and SB 477, the two tax bills that, if the Special Study Committee on Income Tax’s Report is to be taken seriously, are the first steps to eliminate Georgia’s state income tax. The same measures were also passed through the Senate as House Bill 134 and House Bill 463 to satisfy potential constitutional constraints (revenue bills are supposed to start in the House). This tax boondoggle, which is likely a not-entirely-serious election year gimmick, would cut taxes for well-to-do Georgians while eventually raising them for 95% of Georgians. This is because income tax revenue funds half of our state’s budget, over $16 billion.

Here is what these bills do specifically, courtesy of the Georgia Budget & Policy Institute:

“The legislative package would cut the personal income tax rate from 5.19% to 3.99% (Senate Bill 477), cut the corporate income tax rate from 5.19% to 4.99% (Senate Bill 476) and increase the state standard deduction from $12,000 for individuals and $24,000 for married couples to $50,000 and $100,000, respectively while eliminating tax credits (Senate Bill 476). Now, all four bills go to the House.

Despite the legislation’s sweeping impact, members of the Senate rapidly advanced the measures while breaking from the traditional process of hearing public testimony in committee and securing fiscal notes to assess the impact to the state. Instead, the legislation’s sponsors used their own estimates to project that the revenue raising provisions included would generate about $2.8 billion by eliminating a series of corporate and sales tax expenditures. (Senator Parent’s editorial note: the revenue cannot be restored by eliminating all tax breaks and exemptions. As you see, this elimination – and a lot of them are good ones, like the affordable housing tax credit– only total $2.8 billion.)

GBPI estimates that the package’s tax cut provisions would cost $9.5 billion if fully implemented, meaning that Georgia could see an annual budget deficit of more than $6.5 billion if these bills are enacted. That is more than Georgia spends on Medicaid to insure more than two million residents. It’s also more than the state spends on higher education programs to educate more than 500,000 students. Not only would this legislative package create a huge budget deficit that jeopardizes funding for programs that all Georgians rely on, but the majority of tax cuts ($4.8 billion annually) would go to benefit those with incomes in the top 20% who make more than $150,000 per year.”

We had a very long debate on these bills. You can watch my speech from the Well here.

Where will the GOP look to fill the gaps in revenue created by this tax elimination? The only viable option is the regressive sales tax, and that is what surrounding states that don’t have income tax – Florida and Tennessee - have done. A shift from income tax to sales tax is a tax break for the wealthy. Or, as mentioned above, they could dramatically cut public services by shutting down our public universities, for instance, but this also seems impossible. As a Democrat I feel strongly that the burden of taxation should not fall more on the people that have less, and I feel like everyone should pay their fair share.

To that end, the Senate Democratic Caucus has proposed the following bills:

Senate Bill 502 (The Affordability Act) to remove the sales tax from essential household goods, such as including baby supplies, healthcare and first aid items, school supplies, job training materials, energy-efficiency products, and gun safety equipment.

Senate Bill 505 (Georgia Prior Approval for Consumer Insurance Rates Act) to require that private passenger motor vehicle and residential property insurance premium rates must be approved by the Commissioner of Insurance before they can be used.

Reducing Costs for Heart and Lung Transplants

This week, I proudly introduced SB 481. This bill would require Medicaid to provide coverage for heart and lung transplants. Georgia is the only state with the facilities to perform heart and lung transplants but no Medicaid coverage for these procedures.

Each year, patients with chronic heart and lung disease are hospitalized for care. Emory Healthcare estimates that these annual costs can push between $150,000 and $250,000 a year in expenses onto patients. These are NOT costs accrued from performing heart and lung transplants. These are simply the annual costs a patient can expect.

The goal of SB 481 is to invest $1.5 million in state funds which come with a federal match of $3 million. Each heart transplant can cost $350,000 to $400,000 and every lung transplant can cost about $350,000. With this small investment from our state, we can reduce long-term costs for patients, save lives, and improve efficient uses for taxpayer dollars.

Congenital Heart Defect Awareness Week

I introduced SR 642, a resolution to name February 7-February 14 ‘Congenital Heart Defects Awareness Week’ at the Georgia State Capitol. Congenital heart defects are the most frequently occurring defects found in newborns. They are also the leading cause of deaths related to birth defects worldwide. Many are diagnosed at birth, but some are not, and heart defects are a main cause of young athletes suddenly going into cardiac arrest. Despite these concerning truths, there still is not uniform screening at birth nor of young athletes. This is a personal issue for me. I just lost an aunt who lived with a congenital heart defect. She learned of her heart condition when she collapsed after a party in her late teens.

At the Capitol, I introduced SR 642 alongside the Hudson family and Hope and Will, the mascots of CHOA. Joielle Hudons is 22 months old and was diagnosed with a congenital heart condition. Her heart has one large, shared valve instead of two separate ones. Joielle’s condition impacts 1 in every 15,000 to 17,000 births each year. I am so glad the Hudson family could join me!

See my remarks on the Senate Floor with the Hudson family here.

The Hudson Family and our friends from CHOA!

The CHOICE Act

Also this week, I introduced Senate Bill 508 (Community Housing Options Increase Efficiency, or CHOICE, Act) to reward local governments that adopt pro-housing and efficiency policies by giving them priority access to certain state grants and loans. The aim is to tackle our housing affordability crisis by focusing on the supply side, streamlining the construction process.

The FBI Warrant Update

A few weeks ago the FBI raided a Fulton County elections facility and stole ballots from the 2020 election. Now, the affidavit underpinning the raid has been released, and it’s clear there is no new accusation or information. Instead, the affidavit recycles baseless accusations of fraud that Secretary of State investigators and the courts debunked years ago.

President Trump, in addition to refusing to admit he lost, has given election deniers power in his administration and is gunning to “nationalize” elections in our country. The closer we get to the midterms, where he fears losing power, the more he is talking about the 2020 election and interfering in the 2026 midterms. Trump’s blatant power grabs are being sanctioned by some of my colleagues. For example, Senator Greg Dolezal, who is running for Lieutenant Governor and angling for a Trump endorsement, said “It’s past time for the state to take over Fulton County elections until they prove that they are capable of adjudicating our elections in Georgia.” This is all pretextual, but, in SB 202, passed in the wake of the 2020 election, there is a path where the state could take over Fulton’s elections on pretextural grounds. I say absolutely not. Let’s make sure none of these election-denier candidates win in the fall.